Compensation Plan Changes: Lessons Learned from a Volatile 2022 in Tech

A challenging sales environment in the second half of 2022 impacted many companies. In response to climbing interest rates, a softening capital environment, increasing costs from inflation, and rising layoffs, businesses tightened budgets and braced for harder times.

In the coming year, tech leaders expect more of the same, but they also plan to grow through efficiency and stabilization. Carefully-considered compensation plans can help these leaders improve performance by aligning company goals with the actions and incentives of their sales teams.

Compensation plan modifications allow a company to course-correct when the incentives and actions of their sales teams become misaligned with company goals. A mid-year plan modification requires careful consideration and planning, but when done right, it can have a meaningful impact.

In this article, we will explore when and how technology companies changed their sales plans in 2022 to accommodate changing market conditions and, in the best-case scenario, improve performance.

How did technology companies modify plans in 2022?

One of the most common drivers of plan modifications is when there are disconnects between the planned/targeted sales for the company and the actual individual sales across the team.

In 2022, many tech companies experienced big swings in expected revenue growth because of the worsening sales environment. This meant that sales teams that normally performed well fell short of plan. As a result, companies adjusted their sales plans to accommodate new business plans.

Of the companies surveyed, only 20% made zero modifications to their sales compensation plans. Most commonly (about one-third of the time), companies modified more than 75% of their compensation plans. Almost half of the companies modified at least 50% of their compensation plans.

As the data shows, modifying plans mid-year was the norm and not an exception in 2022. Further, 80% of sales managers want to change commission plans at least quarterly, according to our State of Sales Compensation Report.

Naturally, you might wonder what aspects of the compensation plans were changed?

The most common types of plan modifications were:

- Quotas (80%)

- Attainment tiers (75%)

- Crediting (35%)

- Clawbacks (30%)

- Payments (25%)

- Ramping (20%)

“Given the downturn in business for many companies in the technology industry, it is no surprise to see that about three-quarters of plan modifications included a change to quotas and tiers.” — Jacob Sperry, VP of Business Strategy, CaptivateIQ

A quota modification could be as simple as changing the annual targets to re-align individual sales targets with adjusted company targets. Softening sales quotas can keep your top salespeople motivated and engaged in selling hard despite a challenging start to the year. A seemingly small quota modification can be a powerful tool for morale and performance overall!

An example of a more extreme quota modification is changing the quota period. Suppose a company is materially off-pace from its annual quota. In that case, it might make sense to modify the compensation plan from an annual quota to a quarterly quota (with the quarterly quota amount adjusted for new expectations) for the remainder of the year.

When a down market occurs (like it did in 2022), companies frequently respond by making changes to quotas and attainment/accelerator tiers that are intended to help the sales team. For example, lowering quotas or adding new accelerators to reward strong performers.

In a bullish market, companies may modify quotas because they are learning from painful experiences that individuals’ quotas are too easy to hit. While it’s great to beat sales targets, having a large portion of the team overachieve quotas and earning top accelerators can be problematic. Downstream effects may harm sales and marketing budgets and skew customer acquisition cost ratios — capturing unwanted attention from finance leaders.

Learning about different quota-setting methods (and why it’s best to incorporate stretch targets) can help you understand how to design quotas that unlock rep potential.

Suppose a sales compensation scheme gets the attention of finance leaders because over-attainment seems too easy. In that case, modifying quotas and tiers will serve to soften the costs incurred by the company as its sales grow.

While many of last year’s modifications to quotas and tiers likely benefited the individual sales rep, other modifications, like commission clawbacks and payment provisions, more likely helped protect the company. One common company protection is adding a “hold and release” condition, whereby the commission isn’t paid until after a customer pays for the order. Clawbacks similarly ensure that companies aren’t paying reps for customers who don’t pay.

While still not the norm, over 25% of plan modifications changed the payment terms or clawback provisions of the plan. In a softening market, modifying plans can help ensure the company isn't paying commissions for customers who cancel contracts or don't extend beyond a free trial. This can be a powerful way to control costs.

What can we learn from the past?

To summarize:

- 80% of surveyed companies modified some of their compensation plans in 2022, and over 45% modified more than half of their plans. This data shows that plan modifications are a common tool to course-correct sales plans and incentives during particularly turbulent times.

- In a downward sales market, it’s most common to make changes to soften plans, often intending to help encourage sales teams to keep pushing towards their best.

- Correcting weaknesses in plans around clawbacks and payments can help to protect companies from runaway costs.

Market uncertainty means that businesses need to stay agile and be able to adjust quickly to keep up with the changing business conditions. One of the most effective ways to do this is through carefully-designed sales compensation plans.

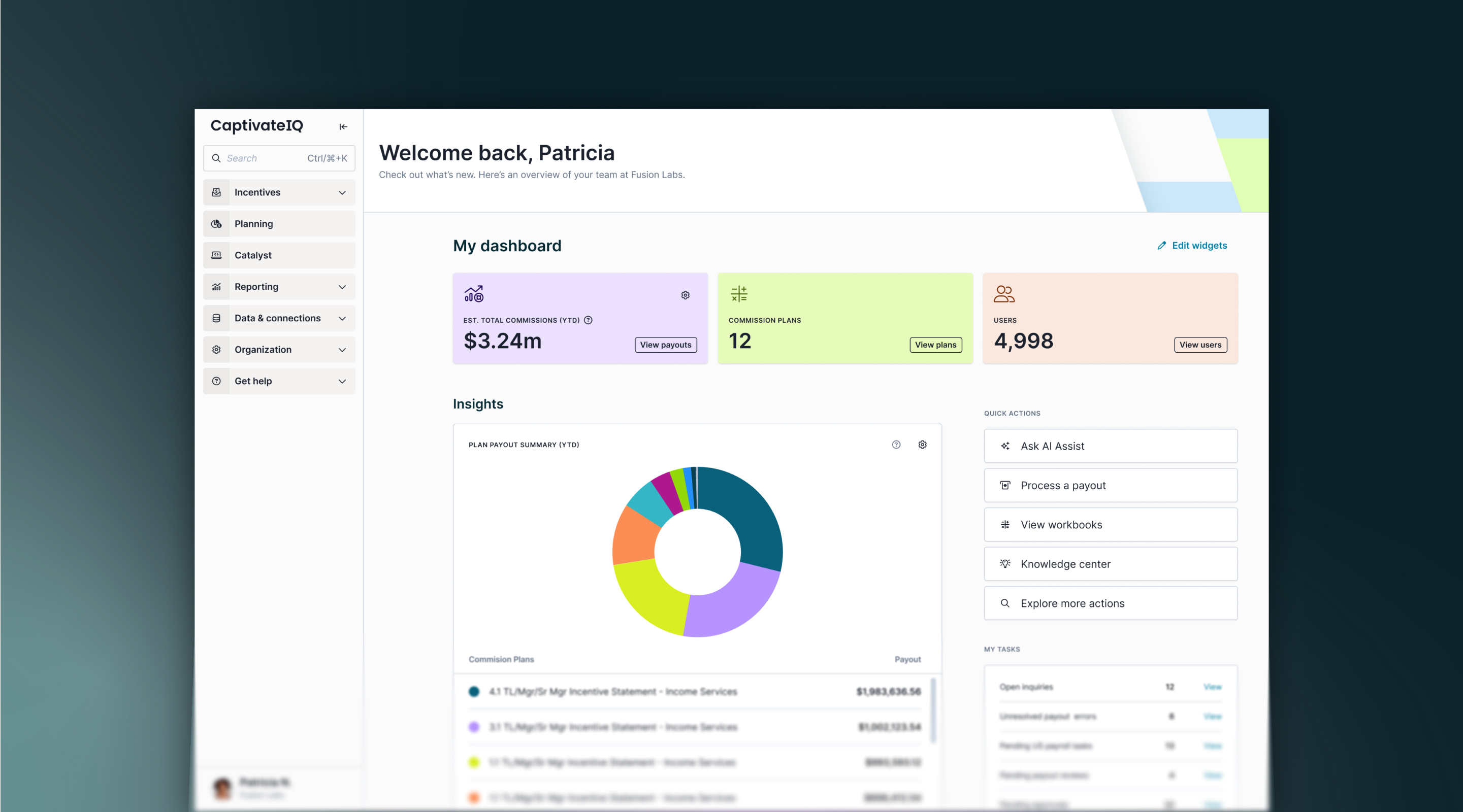

CaptivateIQ’s agile sales commission software helps admins modify and roll out compensation plans with ease. Plus, our statement experience helps salespeople see how they’re performing to new plans and gives them a clear view of the activities that drive results.

“With CaptivateIQ, we found that we didn’t have to change our plans simply to conform to the system. There was no boxing ourselves in, and there were no limitations.” — Ashley N., Controller, JMAC Lending

Give your team the confidence of knowing that compensation plans will adapt to changes in the market!

.svg)