Short vs. Long Sales Cycles: Differences and Strategies for Incentive Compensation

The length of your sales cycles can affect several different aspects of your business, from cash flow to marketing strategies. It should also inform your compensation plan for sales representatives.

Align your incentive compensation strategy with your sales cycle and you can be more sure you’re paying your representatives fairly.

You can also use your compensation plan as part of your sales performance management (SPM) process to motivate your sales teams and encourage effective sales practices.

Let’s take a look at the difference between long and short sales cycles, and how they can influence your compensation plan.

{{multiplier-cta}}

What is a Long Sales Cycle?

A long sales cycle is a full-cycle sales experience with an extended amount of time between the initial customer interaction and the final purchase. The exact definition of a long sales cycle can vary by industry.

However, a long sales cycle often takes several months to complete. In some cases, a long sales cycle can take over a year from start to finish.

A long sales cycle requires your reps to carefully nurture each lead.

The sales rep will build a very strong relationship with the prospect over the course of multiple conversations. Those conversations should include getting to know the prospect’s unique needs, addressing their concerns, and providing support throughout the sales cycle.

Long sales cycles are most common when working with high-value products — big purchases that require extensive research and deliberation. Real estate, finance, and B2B technology are all industries that typically have very long sales cycles.

Benefits of a Long Sales Cycle

A long sales cycle requires focus and persistence from your sales reps, but it can come with a big payoff when the purchase is finalized. Long sales cycles can also lead to lucrative subscriptions or repeat purchases.

While a long sales cycle can be very lucrative, it also comes with some downsides. Long sales cycles are very unpredictable and can result in uneven cash flow, which can make it difficult to plan financially for the future.

There’s also no guarantee that leads will become customers. This means that your sales team could spend an extensive amount of time nurturing a lead with no payoff.

What is a Short Sales Cycle?

In a short sales cycle, the time between the initial customer interaction and the purchase is very limited. What is considered a short cycle could vary from hours to a few months, depending on the industry.

Short sales cycles are present in many industries, although they are particularly common for retail businesses. When buying products with a short sales cycle, customers typically don’t need to do much research or deliberate over the product.

Benefits of a Short Sales Cycle

The interaction between the sales rep and the customer is typically very straightforward in a short sales cycle. While the sales rep will still need to provide some customer support, the focus is less on building a long-term relationship and more on meeting the customer’s needs quickly and efficiently.

The biggest advantage of a short sales cycle is more consistent cash flow and predictability. Closing deals takes less time and effort for reps. However, sales reps working on a short cycle will need to source more leads and close more deals in order to meet their quotas.

Why Do Long and Short Sales Cycles Need Different Compensation Structures?

Commission-based compensation plans are common for companies with both long and short sales cycles. However, your exact commission structure should be built with the length of your sales cycle in mind.

The length of a sales cycle has a significant impact on cash flow, both for your sales reps and for your business as a whole. If you’re working on a long sales cycle, you’ll need a commission structure that helps your reps stay afloat in the long periods between sales.

Commissions are also an important source of motivation for your sales reps. As a result, your commission structure should be designed to reward positive sales behaviors and strategies.

Building Compensation Plans for Long Sales Cycles

Cash flow should be your first consideration when building a compensation plan for a long sales cycle. Since sales reps might go months between sales, a commission-only model likely won’t work here. Instead, offer a base salary to give your representatives a predictable income, with commissions as an add-on.

Base salaries make sure sales reps are compensated for all their work. Adding commissions on top of the base salary provides extra incentive to close larger deals.

For example, you might offer your sales reps a base salary of $100,000 per year, with a 5% commission on each sale. You can adjust these pay rates based on your organization’s budget and your industry. Paying reps a base salary ensures they are appropriately rewarded for their work, even during the periods between sales.

Regardless of industry and sales cycle length, sales reps only spend about two hours per day closing deals. They should spend the rest of the day on important research and business tasks.

Residual commission structures also work well for organizations with long sales cycles, particularly if you have a subscription model or if you frequently attract repeat customers.

With a residual commission structure, sales reps receive a percentage of ongoing revenue the customer generates, rather than a one-time payment. This gives your sales reps a way to increase their earnings between deals and incentivizes them to build strong long-term relationships with prospects.

Regardless of which commission structure you opt for, be sure to keep your company’s finances and cash flow in mind. Even if you are closing large sales, your cash flow may not always be consistent. Structuring your compensation plan conservatively can help prevent you from overpromising commissions, which can lead to a loss of trust from your sales reps.

Building Compensation Plans for Short Sales Cycles

Short sales cycles tend to be much more predictable than long sales cycles, and you can adjust your commission structures accordingly. With a short sales cycle, you can offer a lower base salary and a higher commission rate, as reps will be closing deals much more frequently.

A commission-only compensation structure may also be viable for businesses with short sales cycles. In order for a commission-only structure to work, reps must have consistent opportunities to close deals and generate income.

Some companies with short sales cycles also implement commission caps. A commission cap is an upper limit to the amount salespeople can earn in commissions in a specific time period. For example, you could cap commissions for sales over $1 million to keep your expenses in check.

However, your sales reps might not be motivated to continue selling after passing the capped amount, which can negatively affect your bottom line in the long term.

Use Your Commission Structure to Shorten Your Sales Cycle

Shortening a long sales cycle is a major goal for many organizations, as long sales cycles can make finances very unpredictable. Sales cycles increased for 53% of companies in 2023, and while average deal sizes are on the rise as well, this can create unique financial challenges for growing organizations.

One way to shorten your sales cycle is to change your commission structure so that it incentivizes frequent sales. A tiered commission structure can be a very effective way to do this. In a tiered commission structure, sales reps increase their commission rate as they make more sales. For example, sales reps might start with a commission rate of 5%, but increase to 8% once they hit $10,000 in sales for the quarter.

Tiered commission structures are typically time-dependent, meaning that sales reps will go back to their base rate at the start of a new quarter or new year. This incentivizes reps to make more sales within that time period, instead of letting the sales cycle stretch on.

A simpler alternative is to set quotas or offer flat-rate bonuses for sales in a desired time period. For example, a sales rep could receive a flat 10% bonus for hitting a stretch sales goal within a quarter. You could also require sales reps to hit a certain quota in order to receive their full commission.

To effectively shorten your sales cycle, it’s important to keep these goals realistic. If you set a quota that’s too high, your sales reps could rush to close deals rather than taking the time to appropriately nurture each lead. This scenario could lead to more stress for your sales reps while also making it more difficult for them to attract long-term customers. Setting the right sales goals is a balancing act — they need to be just high enough to motivate your sales team, without being too overwhelming.

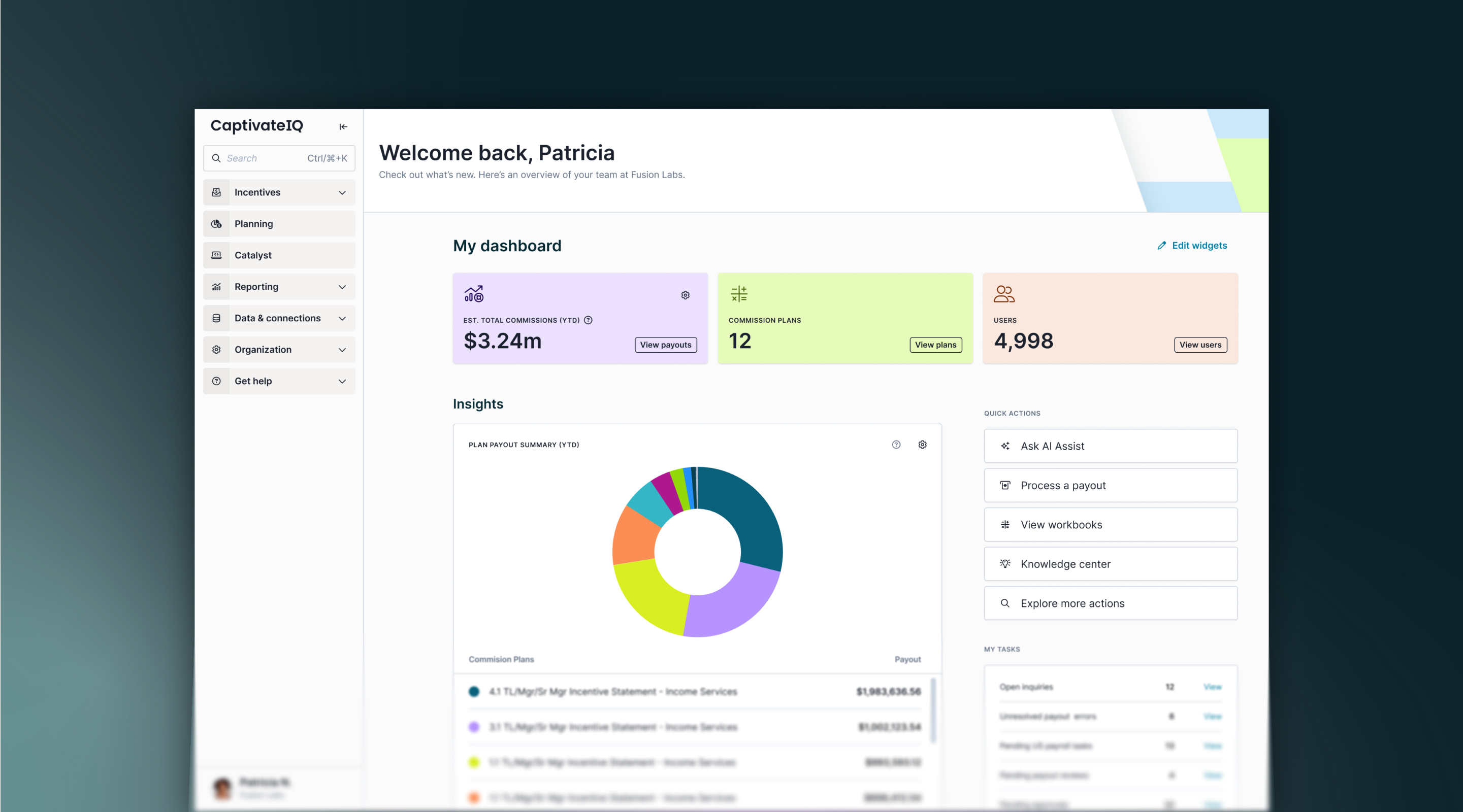

Manage Your Commission Structure With CaptivateIQ

Understanding the length of your sales cycle is key to choosing the right commission structure for your organization. No matter which structure you use, CaptivateIQ has the tools you need to make commission management simple and efficient.

CaptivateIQ’s powerful software helps you calculate commissions automatically, reducing errors and providing more transparency for your reps. Detailed insights help you optimize your commission structure for better performance.0

Schedule a demo today to see CaptivateIQ in action.

.svg)