It’s Time to Recession-Proof Your Compensation Plans. Here’s How.

At the time of this writing (September 2022), the United States of America is in a recession — two consecutive quarters of negative gross domestic product (GDP).

Then again, the answer to “are we currently in a recession” depends on who you ask.

No matter where you stand on the recession/no recession side of the debate, there is no doubt many businesses are feeling the pinch of inflation and an economic downturn ... one that may or may not end soon (predictions below).

Through all of this, companies need to retain and reward their top talent as market shifts unfold. And one of the best ways to accomplish this? Meaningful compensation plans, especially ones that are recession-proof.

We recently hosted a roundtable discussion, featuring four top sales leaders, to better understand how industry-leading companies are recession-proofing their compensation plans.

The entire conversation can be found here. What follows are some key points, a TL;DW*, if you will.

*Watch

Tech layoffs + hiring cutbacks. How have these recent developments impacted your businesses?

Christian Borrelli, Vice President of Global Sales here at CaptivateIQ, shared that at the beginning of 2022, his team had aggressive growth plans to invest heavily in expansion efforts. However, they were cautiously optimistic, hosting monthly “check-ins” to review what was truly happening in the market. From these insights, and out of an abundance of caution, they adjusted hiring plans and annual expectations. Luckily, CaptivateIQ has not seen a massive hit on demand.

Rome Thorndike, Head of Sales at Datajoy — the first self-serve analytics platform built for GTM operators — agreed on leading with caution. He shared that his team has become “a bit more selective” in hiring. They are also “bringing contracts and renewals forward.”

Chris Pitchford, VP of Sales at Ally.io (acquired by MSFT) — a provider of best-in-class OKR software — got a bit technical with some data.

“Stocks and valuations are getting hurt by rising interest rates, especially in the growth company space (companies with earnings in the distant future). For example, during the heart of the pandemic, SaaS public companies had 35x multiples. Those numbers are now back down to 5-7x.”

Chris shared that early-stage companies now need to be hyper-focused on sales and marketing spend. If spend doesn’t correlate to ROI, it may get cut. On the flip side, larger companies (naturally more diversified) can invest more in the employee base. They can be more flexible.

Jeff Ignacio, Head of Sales Operations at Forethought — a platform that “transcends conversational AI to meet customers where they are and help them in the way that works for them” — takes his signals from the public market.

Per Jeff, when the cost of capital increases, SaaS businesses tend to struggle the most. His team is starting to see signals from investors to extend the cash runway.

Like Chris’s comments about ROI, Jeff says buyers are pausing “nice to have” and focusing on “need to have” — tightening their belts. As a result, new initiatives have been put on pause.

Jeff encourages overcommunication with leadership on pipeline and forecasting. He suggests having more frequent forecasting meetings — even daily huddles, if necessary. These meetings should discuss:

- Reexamining marketing spend

- Cutting underperformers

- Doubling down on what’s resonating

Jeff also encourages robust keyword tracking to see what competitors are doing. Are they slowing/stopping spending? Seems like a good opportunity! Are they letting salespeople go? Scoop up some great talent!

The $1B question: How long will this all last?

12 months? 4 years? Obviously, nobody knows, but intelligent, strategic sales leaders have to plan nonetheless.

Here is what the panel predicted (and is planning for):

Rome: 18-24 months. The bond market is helpful to evaluate. With yields collapsing, this points to a more significant slowdown on the horizon.

Christian: 2-3 years? Maybe? But, it “all comes down to if the FED will force a recession to bring down inflation.” If this happens, Christian also backs the 18-24 months time frame.

Same with Chris, a self-proclaimed “glass half full” guy. With the historical average around 15 months, Chris is planning on 18-24 months.

Jeff didn’t hesitate. “We are planning on two years.”

Again, while nobody can predict how long this will all last, it’s important to be tracking the signals and constantly adjusting expectations.

Speaking of signals ...

What are the leading market signals to feel good we are entering a recovery period?

Rome suggests tracking your partners. How are they doing compared to the rest of the market? Are they overperforming? Underperforming?

He recommends avoiding the “big-picture media conversations” as they don’t necessarily apply to your specific industry.

Mark believes in “tracking the pulse around the hiring environment.” Is hiring going up or down? Again, in your industry, not at the macro level.

But what about sales commission plans?

How is your team thinking about changes to compensation plans?

As the agile commission solution that helps companies turn their largest sales expense into a business driver, you knew we’d eventually get to a comps plan question, right?

Jeff and Christian agreed on the following statement: There is strong alignment between a company’s business plan and its comp plan — comp plans are a byproduct of the business plan.

Jeff suggested that “annual plans may be out the window if business objectives change.” He quoted Charlie Munge, who once famously said, “Show me an incentive, and I’ll show you an outcome.”

Said another way, commission plans should drive the behavior you are hoping for.

Jeff said teams should review the underlying dynamics of plans and proactively rethink alternative awards and recognition. They should also consider tightening travel.

Christian said if you leave your comp plan untouched while changing the business plan, you inherently create distrust and misalignment! Never a good thing. This will lead to losing high performers (also, not good!).

Growth (presumably during COVID) has led many companies to “get ahead of their skis” with crazy accelerators and incentives. It’s time to come back down to Earth.

Another sign comp plans are out of whack? Super low quota-to-OTE ratios.

So what’s going on with these crazy quota-to-OTE ratios?

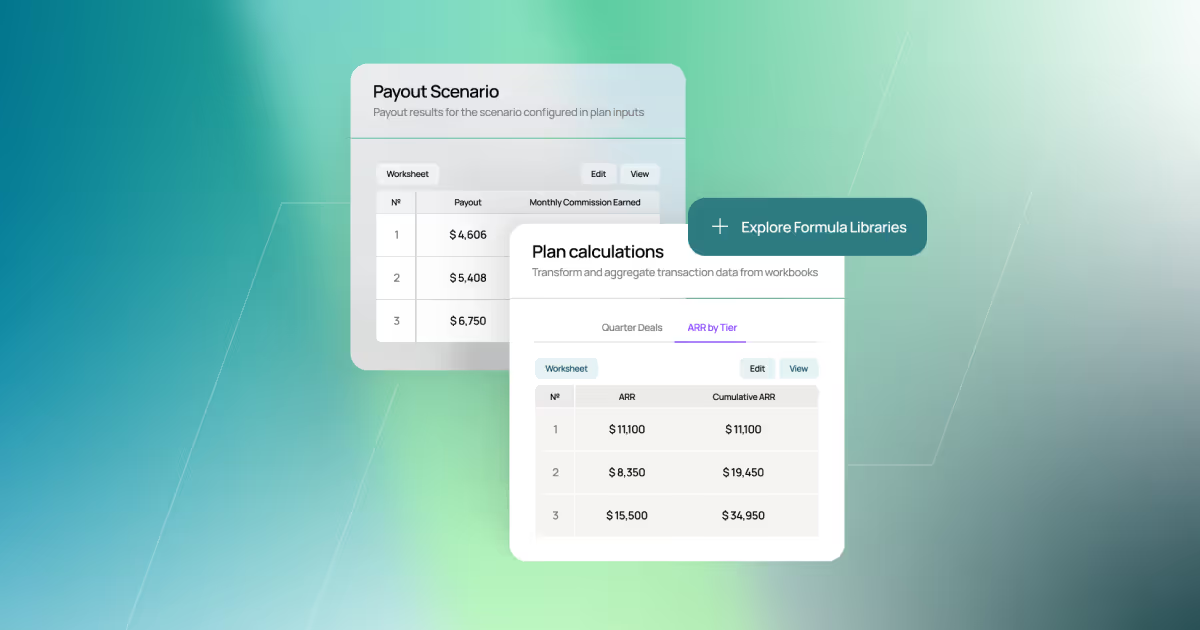

First, a quick definition: OTE or On-Target Earnings are a rep’s base salary plus commission at full (100%) quota achievement. So if the rep carries a quota of $1M annual ARR and the OTE is $200k, the quota-to-OTE ratio = $1M/$200K = 5x.

The quota-to-OTE ratios trend over the past few years has been one of the lowest we’ve ever seen: 1.5x!

How do we get these ratios more aligned with reality?

Per Christian, your team probably has far too many salespeople! “No rep with that multiple is set up for long-term success. Things will break! Investors will not write checks.” Pretty direct.

Jeff said while these low ratios could be a short-term tactic to retain talent, it should be closer to 2-6x in the long run.

But what about other metrics?

What metrics should teams be looking at very closely?

Chris shared that — specifically for startups* — the five key metrics are:

- Growth: 2-3x year-over-year growth that can be directly tied to ROI.

- Gross margins: Focus on the more profitable product lines and subsequently incentivize this in the comp plan.

- Customer Acquisition Cost (CAC) payback: Reduce the CAC period!

- Net dollar retention: This helps with expansion. Shift quotas to incentivize expansion (vs. net new) and try to expand in the first 120 days. Don’t wait until renewal.

- Burn multiple: Ideally should be one or less! Be sure this is communicated downstream too. It’s all about transparency.

*Organizations with enterprise customers tend to be more stable.

Focusing on these metrics can help founders “extend the runway” for up to three years.

Transparency wins the day.

Rome reminds us that salespeople have long memories. Did you take care of them in the past? If yes, you are more likely to do it again.

The key: Be transparent throughout the entire process. Always.

Rome put in “automatic shock absorbers” — if the total forecast went down, all sales reps' quotas also decreased.

What’s next? Is it time for temporary relief?

Short-term (temporary) relief or wholesale comp plan changes?

Well, it depends.

First: Remember that your salespeople are being recruited right now ... as you read this sentence.

Read that again. Your best talent is being recruited!

Christian suggests that if a feature or product update is being released in a few months to positively impact a specific segment, it’s fine to adjust commission plans in the short run. But again, make this clear up front! Set expectations. Put in an end date and decide to extend when it’s close to expiring. Transparency FTW!

If you make big, sweeping changes, save them for the end of the quarter (or year). Don’t change things midstream.

Finally, worth repeating ...

The key to all of this?

Preserve the culture.

Maintain trust.

Be transparent.

Head over to our Events page to find more timely advice on sales compensation and related topics!

.svg)