What is Sales Commission? The Ultimate Guide

What does the perfect pay structure look like for the modern sales rep? We can’t offer a definitive answer, but we can share an interesting data point: According to our Compensation & Motivation Pulse Survey, 81% of respondents say their ideal pay structure would include some degree of commissions.

It's not surprising. After all, commissions are a formidable incentive that ties a seller’s work to their earnings. But more than that, they push your team members to align their ambitions with the company's broader revenue objectives.

There’s always an opportunity to optimize your sales commission strategy and energize your sales force, whether through technology or by exploring new commission structures. We have the tools and insights to help you get there.

Let’s break down sales commissions from A to Z.

{{multiplier-cta}}

Sales Commission: Benefits of an Effective Strategy

It’s a tale as old as time — people are more likely to go the extra mile when they know their efforts have a tangible payoff. In the context of sales, commissions are that payoff. They link performance and reward directly, pushing reps to excel at their job.

As you incentivize the team to perform better, they naturally increase sales volumes and boost overall revenue and growth — in fact, over half (52%) of sellers told us that commissions motivate them to hit their goals.

Commissions also influence employee morale. Fair and transparent reward structures make your team feel valued and compensated for their work. Out of the reps we surveyed, 44% said working for commissions improves job satisfaction, while 43% stated it makes them feel more engaged at work.

Challenges in Managing Sales Commissions

Commission structures are complex and become even more so as the business grows and the sales team expands. Accurate and consistent calculations may become tricky with a mix of different commission types, varying rate structures, and distinct territorial designs.

Then, there’s the potential for disputes — either because you don’t communicate calculations clearly or because sellers don’t have access to accurate records. Regardless, when details are murky, your team may question the accuracy of their commissions.

With a lack of trust comes dissatisfaction and inevitable wastes of time. Over half (53%) of sales managers spend two to three days each pay period resolving disputes. Additionally, 85% of commissionable employees often recheck their payouts to confirm accuracy, diverting time away from activities that could generate more revenue (like selling more.)

8 Types of Sales Commission Structures

There isn’t a universal right or wrong sales commission structure. In the end, the choice boils down to what works for your business — its size, goals, and offerings.

Let’s take a look at the most common structures and what they look like in practice.

1. Straight Commission

Straight commission plans compensate sellers solely on commissions. The commission can be a percentage of the sales amount or a fixed amount per sale.

Since the plan directly ties compensation to performance, it encourages reps to go above and beyond — which sounds good in theory, but also means they might resort to deceitful tactics in order to bump those numbers up.

Straight commissions can also lead to income unpredictability. If no sales are made, the seller earns nothing, which is both stressful and demotivating.

Sales Commission Calculation:

Commission = Sales Amount x Commission Rate (%)

or

Commission = Number of Units Sold x Commission per Unit

For Example: For a percentage rate, if the commission rate is 10% and a sales rep sells $5,000 worth of products, the commission would be $500. For a fixed rate per unit, if the commission is $50 per unit and the rep sells 50 units, the commission would be $2,500.

2. Tiered Commission

With tiered commission structures, commission rates increase as sellers surpass certain thresholds. It’s a system designed to motivate teams to achieve higher sales volumes, as they can earn significantly more than if they just met base targets.

Tiered commissions are more complex to track and calculate than simpler models. They may also demotivate those who consistently achieve below the higher tiers and find them unrealistic.

Sales Commission Calculation:

Different commission rates apply at different tiers. For example, 5% on sales up to $10,000; 7% on sales from $10,001 to $20,000; and 10% on sales above $20,000.

For Example: If someone sells $25,000, the commission would be calculated as:

$10,000 x 5% = $500

$10,000 x 7% = $700

$5,000 x 10% = $500

Total commission = $1,700

3. Base Salary + Commission

This hybrid commission structure combines a fixed base salary with a variable commission based on sales performance. It provides sellers with income stability during slower periods while still prompting them to achieve higher sales.

This model has drawbacks. For one, it requires a consistent payroll expense regardless of sales performance. Additionally, the security of a base salary might reduce the urgency to close deals, particularly if the commission rate is relatively low.

Sales Commission Calculation:

Total Earnings = Base Salary + [Sales Amount x Commission Rate (%)]

For Example: If a rep has a base salary of $2,000 per month and earns a 5% commission on $30,000 of sales, their total earnings for the month would be: $2,000 + ($30,000 x 5%) = $2,000 + $1,500 = $3,500.

4. Draw Against Commission

A draw against commission is an advance payment to sellers against their future commissions. The advance is then "paid back" by the commissions earned. Draws can be recoverable (must be paid back) or non-recoverable (not required to be repaid if commissions do not cover the draw).

This model provides regular income, and is especially useful in industries with long sales cycles. It also helps integrate new people into the sales team without financial pressure as they build their client base.

Keep in mind that managing recoverable draws can complicate payroll and may lead to issues if sales do not cover the draw. In the case of recoverable draws, reps might end up owing money back to the company if they consistently underperform.

Sales Commission Calculation:

Total Earnings for the Period = Total Commissions Earned - Draw Amount (if recoverable)

Example: If a seller receives a monthly draw of $1,500 and earns $2,000 in commissions for the month, their payout after recovering the draw would be: $2,000 - $1,500 = $500.

5. Gross Margin Commission

Gross margin commission plans base the commission not on the total sales volume but on the profit margin of the sales. They’re designed to incentivize reps to sell more profitable items or negotiate better terms to maximize their earnings.

The model does requires transparent access to cost and profit data, though, which may not always be available or accurately tracked.

Sales Commission Calculation:

Commission = (Sales Price - Cost of Goods Sold) x Commission Rate (%)

For Example: If a rep sells a product for $1,000, which costs $700 to produce, and the commission rate is 10%, the commission would be: ($1,000 - $700) x 10% = $300 x 10% = $30.

6. Residual Commission

Sellers receive residual commissions for customer payments that recur after the initial sale. This is common in industries where clients pay subscriptions or ongoing service fees, and motivates reps to maintain customer relationships over time.

The downside is that earnings are tied to the client's willingness to continue paying, a factor that’s not always in the seller’s control. It may also take time to build up significant earnings, which can be a downer for those who are new to the team.

Sales Commission Calculation:

Commission = Recurring Payment Amount x Commission Rate (%)

Sales Commission Example: If a rep secures a client who pays a monthly subscription of $100, and the commission rate is 5%, the rep earns $5 each month as long as the client continues to pay.

7. Revenue Commission

Revenue commission structures are based on the total revenue generated from sales, regardless of profitability. This approach is easy for sellers to understand and calculate, and keeps the team focused on generating revenue.

Revenue commissions may encourage the sale of high-revenue items without regard to their profitability. Reps might be tempted to offer discounts to close deals, potentially affecting a company's bottom line.

Sales Commission Calculation:

Commission = Total Revenue Generated x Commission Rate (%)

For Example: If a seller generates $50,000 in sales and the commission rate is 6%, the commission would be $3,000.

8. Territory Volume Commission

Territory volume commission is awarded based on the total sales generated within a specific geographic area or market segment. It’s a useful structure for businesses that have a clear regional distribution of sales efforts and encourages regional market penetration and growth.

Territory volume commissions can promote teamwork among reps working in the same region to collectively boost regional sales. However, some territories might inherently have more sales potential than others, so there’s an automatic disparity in earning opportunities.

Sales Commission Calculation:

Commission = Total Sales in Territory x Commission Rate%

For Example: If total sales in a designated territory are $200,000 and the commission rate is 2%, the commission would be $4,000.

An Overview of Average Commission Rates by Industry

No two industries are the same. The principle applies to everything from size to customer base and, of course, commissions.

Here's an overview of the typical commission rates by industry to give you a benchmark of what to expect.

Technology

In the tech and SaaS sectors, commission rates generally start around 10%, but can range from 5% to as much as 20%. Reps often need to meet specific quarterly targets or quotas to earn these commissions.

Real Estate

The typical commission rate for residential real estate agents falls between 5 to 6% of the home’s sale price. Commercial real estate agents see a bit more variability, with average rates ranging from 4 to 8%.

Insurance

Insurance sales, including auto, home, and life, are heavily reliant on commissions. Captive agents, who represent only one insurance company, generally earn commissions of 5 to 10% of the first year’s premiums on policies they sell and often receive a base salary.

Finance

Commission rates in the finance industry vary by product. For instance, mutual funds may offer an average commission of 0.25 to 1%, while annuities and other products may offer between 1% and 10%.

Auto

Auto sales representatives usually earn purely from commissions. Commission rates in the auto industry are relatively high, with dealers commonly offering 20 to 30% of the car’s sale price as commission.

Pharmaceutical

Pharmaceutical sales reps usually earn an average annual commission of $44,798, with a significant portion of their income derived from these earnings.

Travel

Travel agents’ commissions typically range from 1 to 20% of the total sale price, in addition to possible flat fees for each booking.

Retail

Commission rates in apparel retail are approximately 15%, but this can fluctuate depending on the product sold. Meeting sales quotas is often required to qualify for commissions.

The Role of Sales Commission Management Software

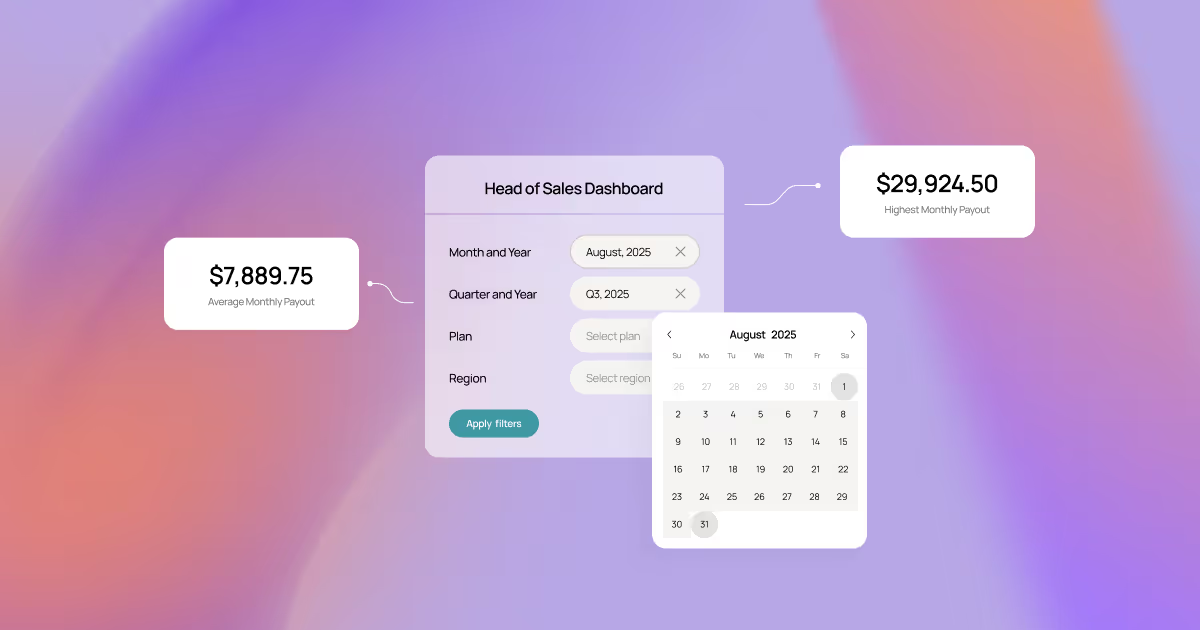

As the age of the spreadsheet fizzles out, sales teams and leaders turn to technology to streamline their operations. Sales commission management software is leading the charge, with tools that simplify the administrative load and improve seller performance.

The technology reshapes how sales leaders manage commissions. It automates calculations and integrates real-time data from different sources — such as CRM and ERP systems — for a transparent, less error-prone process. Integration means that sales data, customer interactions, and final transactions are all synced, so you have an a holistic view of each rep’s performance and corresponding earnings.

With all this information under a single roof, you have at your disposal a platform to analyze performance trends and identify areas where you can optimize the sales strategy.

The benefits extend directly to your team as well. With access to their earnings and transparent breakdowns of their commissions, sellers are more motivated and aligned with the company's goals. They can see the immediate impact of their efforts on their earnings — the perfect cocktail to boost morale and drive them to achieve and exceed their targets.

CaptivateIQ: A Modern Solution for Sales Commissions

At CaptivateIQ, we’ve been hard at work developing a suite of tools that transform commission management. We empower sales teams and leaders with technology that speeds up commission calculations and enhances transparency and accuracy — all while integrating with existing business systems.

Ready to see how it all works? Schedule a demo today and experience firsthand how CaptivateIQ can revolutionize your approach to sales commissions.

.svg)