Make Your Approvals Process a Breeze

How companies approve employee payouts varies, depending on the size of the company.

In smaller companies, approvals are as easy as e-mailing every member of the team to confirm their statements are correct. Payment disputes are easily resolved simply because the size of the team is small, and inquiries are easily tracked via e-mail.For mid-sized companies, approvals become a bit more cumbersome but still manageable. Some teams may opt to forgo the approvals process and request that reps send an e-mail to Finance or HR should there be a dispute. However, as manual calculations increase and team size increases, the number of re-processed payments and one-off, out of cycle payouts grow making the need for an approvals process more acute.Finally, for larger companies, approvals becomes a necessary process. For example, having a paper trail of approvals can help mitigate potential risks identified by auditors. It also makes it easier to address potential disputes or escalated legal issues. For most large teams though, securing approvals means not having to deal with a high volume of re-processed, out-of-cycle payouts.

Secure all of the approvals and statements you need within a single platform.

At CaptivateIQ, we believe that companies of all sizes deserve a robust and efficient approvals process. We believe that the ability to have a robust approvals process should not hinge upon the question, “Do we have enough time?”

To date, teams have had to run through some variation of the following process to secure approvals.

- Ask payee to review payout to ensure nothing is missing or off

- Obtain payee approval

- Resolve inquiries or disputes

- Confirm with your team when all payees have finalized their amounts

- Share final numbers with Finance/HR/Payroll to initiate payout

- Save all documentation for audit, compliance and legal reasons

The entire process likely happens in a series of scattered e-mails that are difficult to sort through or recall.

How our software works.

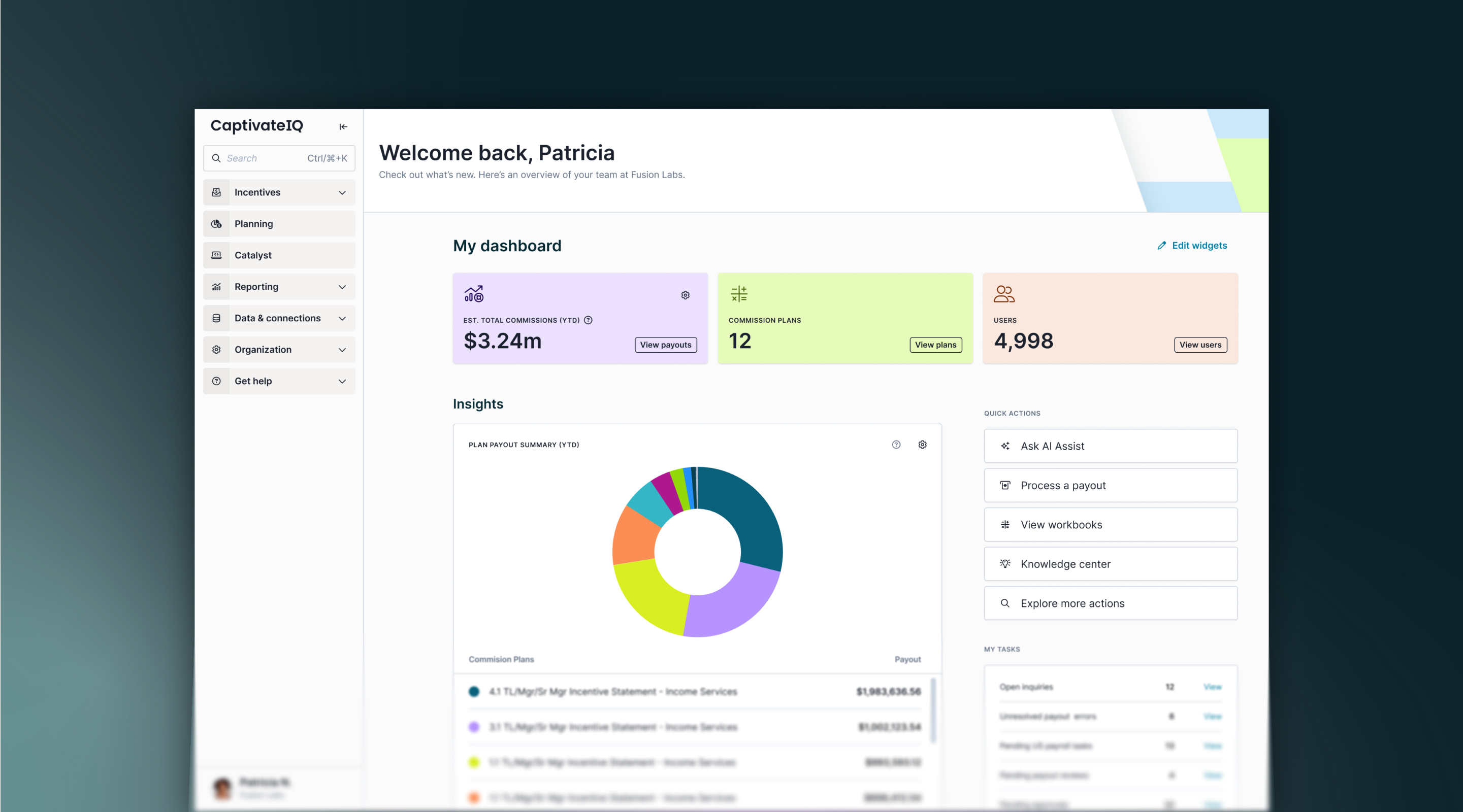

On CaptivateIQ’s Payouts page, you can:

- Control when payees are able to view their statements

- Request approval from payees by a certain deadline

- Keep track of each payee’s approval status

You can also create automated workflows that allow batches of payees to go through the same approvals process. For payees, giving approval is as easy as clicking a button.

For Finance and RevOps admins managing and processing these payouts, it saves them time and headache having to go back to rerun the numbers for greater legal and audit compliance. Admins will also be able to view the status of all payouts and add new approval requirements directly on the payouts page. For reps, Approvals allows them to sign off on their payout before they receive their paycheck so there's greater trust and confidence in how they're getting compensated.

How teams get compensated for their hard work shouldn't be a black box where only a few people have the keys to unlock it. By making compensation more transparent, timely, and most importantly, accurate, we believe that will enable people to do their best work.

.svg)

.avif)